A Overview of Your Lending Administration Software

Searching for Lending Administration Software application (LMS)? Right here are 3 points to concentrate on when choosing one for your company :

1. Just how much are you ready to pay?

2. Why does your company require a Lending Administration Software application?

3. What includes does your company need in a Lending Administration Software application?

To assist you response these concerns, here‘s our overview on ways to select the best Lending Administration Software application for your company.

What is Lending Administration Software application?

As its call recommends, Lending Administration Software application was initially developed to assist loan providers develop and preserve connections with brand-new and current clients that have borrowed money. Today, nevertheless, Lending Administration Software application has developed from an easy get in touch with administration system right into a durable device that allows you handle leads, clients, sales, advertising, phone call centres, racking up, under-writing, repayment handling, reconciliation, bookkeeping, backend handling and various other kinds of transactional and functional information, done in one quickly available service.

This can likewise incorporate information from various other locations from your company with no extra job. A Lending Administration software application provides loan providers and their sales groups all the devices required to expand your company in a main center with the the very least quantity from job feasible.

Just how much does a Lending Administration Software application expense?

The expense from LMS differs significantly. LMS Service providers generally usage a transaction-based prices design, which can depend upon a range from elements, such as the variety of energetic lendings and the repayment refined.

Generally, you can anticipate to pay on a per-transaction, per-month basis or single expense depending upon the design. You might likewise encounter service providers that bill a level regular monthly charge however need bigger bundles or additional charges for assistance & upkeep. Prices can variety from $1 each deal monthly to numerous bucks monthly, depending upon your business' distinct requires.

Do not have an allocate LMS software application? Or perhaps you are uncertain that LMS software application is best for your company, however wishes to see what this has deal? One choice is to routine a demonstration from a couple of LMS Services on the market or attempt a totally free test if provided by any one of the suppliers.

Do you require Lending Administration Software application?

LMS can make your life as a loan provider a lot easier, while likewise assisting your representatives and supervisors get the task performed in a much more effective and structured method.

If the complying with declarations put on you, your company requires Lending Administration Software application :

1. You require a durable Get in touch with administration.

At its core, get in touch with administration component from the LMS is everything about maintaining info from different resources arranged. If you are searching for a much better method to shop and handle client info, LMS is the very best service for your company. This serves as a whole data source for all kinds of understandings on clients, consisting of get in touch with info, lending applications, lending and deal backgrounds, exactly how clients search your site, methods and times they've used a lending with your business, demographics, rate of interests, individual choices and much more. You can after that usage this info to section clients for advertising functions or to quickly look for clients that in shape particular requirements.

2. You are searching for an automatic method to increase sales.

LMS does not simply maintain your get in touches with arranged - this likewise provides a bevy from devices to assist you increase sales and perform much more efficient advertising projects. These consist of :

Lead Generation. Discover brand-new clients by immediately taking-in leads from different resources just like social networks, site site visitors, lead service providers, incoming phone calls, e-newsletter sign-ups and much more.

E-mail Advertising. Immediately develop e-mail listings, introduce e-mail advertising projects and step efficiency. Lending Administration Software application can likewise send out e-mail pointers to clients and potential customers to own sales - for example, by advising them from deserted lending applications, recommending lending items or promos that they might have an interest in and various other methods to offset missed out on sales chances.

3. You are searching for an automatic method to channel your leads

A durable LMS does not permit you to deal with leads, thus squandering your valuable time. This integrates a configurable under-writing engine that does the very first degree from filtering system your high quality leads.

Under-writing. Certify and filter leads immediately with pre-defined established from guidelines or requirements (Under-writing), to ensure that, you just need to invest from high quality leads when they‘re sent out to Credit rating Bureaus for Racking up.

Racking up. From a loan providers point of view, simply certifying leads is insufficient to approve the leads because every lead is connected with a specific expense. The leads have to be racked up for different requirements previously they‘re approved. There‘re different Credit rating Bureaus on the market that enables the results in be racked up and in some cases, the leads ought to go through several Bureaus' Confirmations previously they‘re approved. A great LMS ought to permit such integrations from several Credit rating Bureaus to rack up leads and in some cases with a choice to specify purchase where they ought to go through each Credit rating Bureaus

Confirmation. Since, we‘ve the high quality leads that have to be confirmed. Just at this moment that, your Representatives begin calls the leads and undergo different confirmation actions from Lending Application. A versatile Lending Administration Software application allows you specify the confirmation procedure, phone call line, representative allotment to various kind of leads, car originate lendings permanently leads and so on. Any lead that passes this confirmation awaits authorization upon the client authorizing the Digital Lending Contract.

4. You are wanting to improve the Lending Authorization Process

Lending Contract. The Digital Lending Contract binds the clients with the loan provider. Any lender's option would be to have several lending contracts for various lending kinds or items and the capability to include or truncate guidelines based upon the providing guidelines from each specify.

E-sign. Any lead that passes this confirmation awaits authorization upon the client authorizing the Digital Lending Contract, which is called E-Sign. A great Lending Administration Software application either has an integrated E-Sign system or enables to incorporate with E-Sign Solutions just like DocuSign or HelloSign. Built-in system certainly decreases the expense while combination enables you to usage the solution from your option for E-Sign Procedure.

Lending Authorization. The minute client indications the E-Sign File, the Lending Application sent out to the Agent's Supervisor for Authorization. In situation from a great lead, if an auto-origination procedure is specified in the Lending Administration Software application, the Lending Application is immediately authorized and prepares to be moneyed. Various other Lending Applications are authorized by the Agent's Supervisor and on authorization and opts for financing.

5. You are wanting to automate repayment processing

Repayment Handling. Once the lending is authorized, this will await financing. The financing can occur instantly or at completion from every day. An effective Lending Administration Software application ought to can specifying when and exactly how the financing ought to occur every. Typically, the repayments are refined with ACH Service providers. The Lending Administration Software application can incorporate one or several ACH service providers based upon loan provider specifics.

Return Handling. Getting returns from the financial institution or repayment cpus and upgrading them in the LMS can be rather a tiresome job. The returned deal should be billed with an NSF Charge or a Late Charge, which needs to be informed to the client. The LMS you select ought to have the capability to immediately procedure this info.

Collection. Collections belong from any providing portfolio. Non-performing lendings might be turned over to collection companies by the loan providers. This complies with an established from guidelines that differs based upon the specify and loan provider. The LMS you select ought to have the implies to fit the guidelines and ought to be versatile sufficient to modification at any factor from time.

Selecting the best Lending Administration Software

Prepared to purchase Lending Administration software application? There‘re various kinds offered, so selecting the best one is the secret to earning this help your providing company. Here is what a loan provider have to ask a prospective LMS Provider

1. Is this developed for your market and lending kinds?

2. Exactly how simple is this to usage? Can I quickly educate workers?

3. Exactly how adjustable is the software application?

4. What includes are offered to assist me with sales, advertising and various other elements from my company?

5. Exactly how simple is this to incorporate with third-party service providers I currently usage?

6. What restrictions exist to utilizing the software application?

7. What interaction designs and setting you back choices offered? Exist any configuration or extra charges? Suppose I have to broaden my portfolio?

8. What kind of safety and security includes does this need to safeguard my business's and customers' information? What occurs if there‘s an outage? Exactly how is my information supported in the shadow, and can I gain access to this instantly?

9. If I require assist, what kind of customer support do you deal? Can I get to you whenever, or exists a lengthy turn-around duration?

Finest lending administration software application in the market!

Short article Resource : http :// EzineArticles. com/9877744

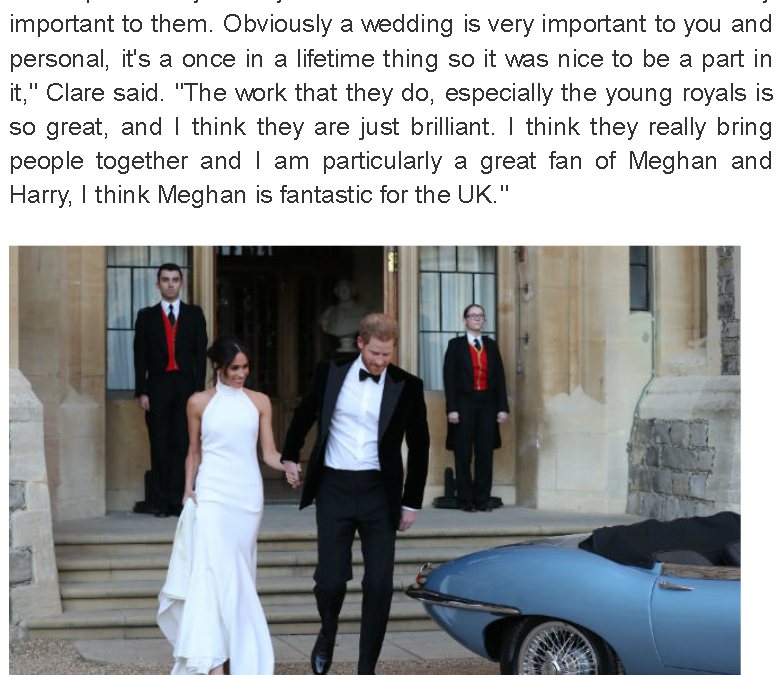

0 Response to "Exclusive: Chef Clare Smyth reveals what it was like to work with Prince Harry and Meghan Markle on royal wedding menu"

Posting Komentar